How to adapt to the agency sales model: A 4-step guide for car dealers

According to an exclusive investigation by Car Dealer Magazine1, 18 car makers have already switched or are planning to switch to agency sales in the UK, while only eight have ruled it out completely. The rest are either silent or undecided. Agency sales model is coming and aims to significantly change the business model and large part of operations of a typical car dealership. The profitability, among other parameters, is under attack here. So how can a dealership adapt and protect its business?

The agency sales model is a new way of selling cars that is gaining popularity among car manufacturers and consumers. In this model, the car manufacturer sells the car directly to the customer via its own website, and the dealer acts as an agent who delivers the car and provides after-sales service. The dealer receives a fixed fee from the manufacturer for each car sold, instead of earning a margin from the sale price.

The agency sales model has several advantages for both the manufacturer and the customer. For the manufacturer, it allows them to control the pricing, distribution, and marketing of their cars, as well as to collect valuable customer data. For the customer, it offers a transparent, hassle-free, and consistent buying experience across different channels and locations.

However, the agency sales model also poses some challenges and risks for car dealers, who have to adjust their operating model and strategy to survive and thrive in this new environment.

So how can car dealers adapt to the agency sales model and maintain their profitability and relevance? Here are some recommendations based on best practices and expert opinions:

-

Focus on customer service and retention

The agency sales model reduces the dealer’s role in the sales process, but increases their role in the service process. Therefore, dealers need to focus on providing excellent customer service and building long-term relationships with their customers. This can help them generate repeat business, referrals, and loyalty. Dealers can also offer value-added services such as maintenance packages, accessories, insurance, and financing options to increase their revenue streams.

-

Embrace digital transformation

The agency sales model requires dealers to adopt digital tools and platforms to communicate and interact with their customers and manufacturers. Dealers need to invest in online presence, e-commerce capabilities, CRM systems, and data analytics to enhance their efficiency, effectiveness, and customer satisfaction. Dealers can also leverage social media, online reviews, and content marketing to increase their brand awareness and reputation.

-

Collaborate with manufacturers

The agency sales model changes the relationship between dealers and manufacturers from adversarial (or at least cautious and tense) to collaborative. Dealers need to work closely with their manufacturers to align their goals, strategies, and operations. Dealers can also benefit from the manufacturers’ support and resources in terms of training, marketing, technology, and incentives. Dealers should also provide feedback and insights to their manufacturers to help them improve their products and services.

-

Diversify your portfolio

The agency sales model may limit the dealer’s ability to negotiate prices and discounts with their customers and manufacturers. Therefore, dealers need to diversify their portfolio of brands and products to cater to different customer segments and preferences. Dealers can also explore new opportunities in the used car market, which is expected to grow in demand and profitability in the era of transformation towards electromobility.

The agency sales model is not a threat but an opportunity for car dealers who are willing to adapt and innovate. By following these recommendations, car dealers can create a competitive edge and a sustainable future in the changing automotive landscape.

Do you want to help with the digital transformation of your sales, marketing and aftersales care? Our consultants are happy to discuss your current issues. Contact us!

Four useful improvements in the latest Automotive CRM update

Successful sales today can no longer be achieved without a perfect customer experience. And you don’t create that by accident or by relying on a constellation of stars and the talents of your salespeople. You can only deliver it consistently by maximizing your customer data. Automotive CRM with its latest batch of new functionality will be a useful tool to help you do just that. Let’s take a look at how they can help you wow your customers.

Automotive CRM is not just a sales tool. Together with its other extensions such as Marketing, Customer Care or Power BI, it is a comprehensive solution for leveraging the data you collect and effectively managing your customer relationship. The new version therefore brings a number of enhancements, inspired by requests directly from our customers. They will therefore help you to better manage everyday situations that arise in sales, purchasing, marketing or customer care.

Data quality first

The goal of our solution is that one person (customer) is in the system only once. This is regardless of whether they are in multiple companies or buy different brands. In order to achieve this, after cleaning up the customer databases, we face the challenge of preventing the creation of new duplicate records.

The Dynamics 365 platform allows you to set duplicate detection rules individually, according to customer preferences, across all record types. Thus, in addition to the normal rules for contacts or companies, we can also set rules after valuation or redemption in the form of the same VIN of the vehicle. Then you can, for example, easily detect a customer who tries to sell a vehicle at different branches in order to achieve the highest possible redemption price.

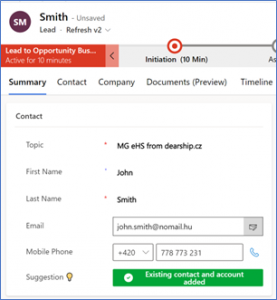

Smart suggestions of pre-existing records

A new feature of so-called “smart suggestions” saves time and effort when working with new leads or contacts. An internal algorithm automatically detects which existing record the lead is likely related to. Suggestions find practical use specifically for leads that have arrived to CRM from web forms or directly from the manufacturer. In the context of leads, we proactively alert users of possible duplications. This smart solution goes even further. It will also offer a selection of business relationships if it is already linked to the contact.

This innovation complements other Automotive CRM tools such as DQC (Data Quality Control – a dialogue with selected data that can be activated during or at the end of the sales process) or integration to registers such as ARES or FINSTAT.

Proposal of an existing contact and business relationship (only available on Refresh v2 form)

Contact was successfully linked to lead

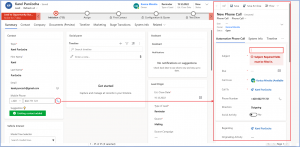

More information at your fingertips when you talk to the customer

When we call a customer, it is always to our advantage to let them know that we know who they are and our shared history. So in the new version, we’ve virtually bridged the two worlds – the recording of the phone call and the context of the deal in progress. Using the phone icon, you can bring up a sidebar with new outbound call activity. Compared to the standard behavior, the main record is still editable, so the salesperson can add information to the lead during the call. Or he can open a 360° view of the customer and immediately see the history of all interactions and deals. Another nice example from practice is the use in call centers, where during the call the agent can trace the last service transactions or complaints.

New phone call creation

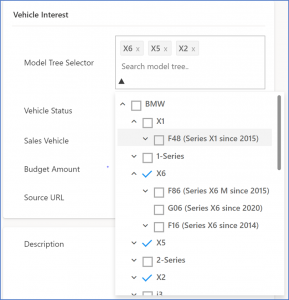

We have also improved the input of model tree information. All models are now only in one field. There, a specific model can be selected, or the entire model tree can be expanded to select the specific models and series the customer is interested in.

Model tree with multiple selection options

Get the most out of the Microsoft platform

A huge advantage of Automotive CRM is that it is built on the Microsoft Power Platform. This brings smooth cooperation with the increasingly powerful Microsoft Office / Microsoft 365 tools.

As a result, our customers routinely work with Word templates to print handover reports and contracts, use Excel exports/imports for bulk data or analyse and report their performance with the help of Power BI dashboards, that can link to data from ERP or other marketing tools. Of course, it is also connected to Outlook, which enables synchronization of calendars, contacts, and tasks.

With the new version, we are introducing a connection to another platform from the Microsoft family – the Microsoft Teams communication tool. Teams is now available on all major record types and chat cards contain contextual information about the vehicle or customer along with a link to the CRM record.

A card from Microsoft Teams chat with url link to CRM record

Compared to traditional email communication, Teams is a more effective tool in situations where you need a flexible and immediate response, for example:

- Inter-branch communication (vehicle availability, transfers, test drive planning…)

- communication with other departments (finance (F&I), offers, fleet, buyout, valuation…)

- workflow communication (approvals, bookings, change of owner, allocation of leadoff…)

Automotive CRM interface with integrated Microsoft Teams chat

And that is just a teaser…

In the next post, we will introduce more features from the release such as a brand new view of customer sales history, working with photos, new reporting and notification options or we will reveal behind the scenes how we monitor customer processes (flows) to ensure the best follow-up service.

New features in the spring release of Automotive CRM

We are constantly working on improvements to our product, responding to customer feedback and adding more practical features. In the latest release, we focused on expanding the supported sales scenarios, improving the user experience or extending the 360° view of the customer to see the real value they bring to our business. Let’s take a look at the most interesting new features in a bit more detail.

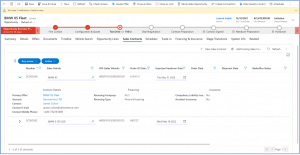

Fleet sales – managing multiple sales contracts

We understand that the “one opportunity equals one sales contract” scenario is not the most effective way to leverage the potential of Automotive CRM in B2B or fleet sales. So finally, we’ve added the ability to convert each offer into multiple sales contracts. This eliminates the need to create redundant deals because you can choose the number of contracts created when converting a deal.

Multiple contract management

Information about related contracts can now be found easily on the opportunity or offer tab.

Contracts on Vehicle tab

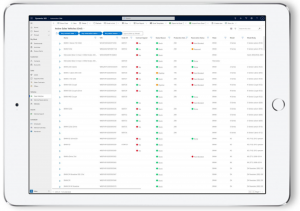

No more cumbersome filtering

We know from user feedback that what Dynamics 365 really lacks is a nice, clear view of data with effective filtering. So, we developed a tailored view that allows for lots of tweaks such as moving columns, quick filters or colour coding of results. Thanks to the so-called bookmarks, the user can save his or her view of the data and easily use it again.

Filtering grid

Stay in the loop with push notifications

Push notifications are short messages that appear on your mobile phone screen. You can know them from your email client or other communication platform (Teams, Messenger, WhatsApp…).

In the case of Automotive CRM, you can individually set which information you are interested in. The notification always contains a short text with a link to the record directly in the CRM. For example, you can choose from information about bookings, changes in vehicle production or we also support notifications when a lead or opportunity is assigned to a user.

Every click counts

For a better user experience, we are introducing a number of improvements that make working with the system more efficient. For example:

- leads can now be generated in bulk from multiple record types – for example, directly from a vehicle for sale

- the ability to put multiple leads to sleep at the same time

- reopening of offers with the possibility to change the vehicle

- automatic update of existing customer data during the process of qualifying leads

- management of primary vehicles in open opportunities

And that’s not all. The spring release contains many more of these new features, we’ve selected only the biggest ones. Want to know more about AutomotiveCRM? Contact us, we’d be happy to show you the system.

All new features are described in detail in the release notes:

MD-Bavaria Žilina benefits from the capabilities of AutomotiveCRM

We’ve connected all the available data into a 360° view of the customer, put it in the hands of sales reps in a few clicks, and streamlined marketing lead acquisition and follow-up. And that’s not all AutomotiveCRM can do.

MD-Bavaria is an authorized dealer and service center for BMW and BMW Mottorad. The company management was looking for a solution to replace and unify the in-house customer relationship management tools. The existing information systems were not synchronized with each other, creating problems with data quality, and sharing of the information across the company. Data, ideally integrated and easy to use, is now needed by everyone – sales, marketing, after-sales, service and, of course, management. The implementation of the new Automotive CRM solution is built on the Microsoft Dynamics 365 platform and supports the specific sales processes of the dealership.

MD-Bavaria AutomotiveCRM training by Konica Minolta IT Solutions Czech

With Automotive CRM we have brought several benefits to MD-Bavaria:

- Connecting various sources of information in a complete 360° view of the customer and vehicle, in which sales, service and interaction history can be tracked.

- A tailored system for managing business processes.

- Improved data quality supported by the connection to the Slovak FINSTAT register.

- More efficient work of marketing in planning and evaluation of sales activities and lead management.

- System readiness for integration of another branch

- The system is ready for further extensions

After deployment, there is an onboarding phase where we help the customer with the most effective adoption. Colleagues at MD-Bavaria will thus be able to start using all the benefits and functions of the system more quickly. And we look forward to further cooperation.

Header photo: MD-Bavaria website

Care for dealer service customers has changed

Coronavirus has changed the rules for automobile repair shops, and not only in terms of operating hours. Due to the fact that some customers postponed the purchase of a new car and some could not or did not arrive for their regular service interval, in 2020 the usual course of things changed. How do you deal with these changes?

End of service as we know it

The lifecycle of automobile repair shops was quite simple until 2020 (and let’s add even until 2008/2009). A portion of revenue was more or less fixed and predictable, thanks to regular warranty inspections. These revenues increased with special events from car manufacturers, or with seasonal inspections as part of the importers marketing activities, while a significant portion of the revenues were from random but regularly occurring traffic accidents. More or less, after the end of the factory warranty, some clients would leave the branded service, usually part of a dealership, to a generic service. Some branded services have been trying to address this customer outflow for some time with discounts on their hourly rate for servicing older cars; not always successfully. Overall, however, there was not much pressure on the automobile repair shop. This was all true before the arrival of coronavirus. But what does the situation look like now?

Planning sales and service work is suddenly much more difficult

Most automobile repair shops have always focused primarily on capacity planning. The financial side of things then followed. However, now the situation has changed. It is no longer enough to do what you used to do to maintain service sales. Some customers suddenly cannot afford a complete service, some will look for cheaper alternatives including purchasing parts (typically brake pads, discs, and engine oil) directly. There is also an element of fear that at the service center, other, unexpected and expensive repairs may emerge. In addition, many companies are saving on service. A bit of certainty comes from cars that are operationally leased, where service was included in the price. Automobile repair shops still have high fixed costs and firing capable mechanics is not exactly the optimal solution for the future. What can be done then?

Even a car service will have to do marketing and sales

Marketing and sales need to be engaged. How? There is new demand for extending the lifecycle of a car. If you know which of your customers decided not to renew their fleet at the originally planned interval, it will be easier to offer them your service. Perhaps with some discount, but it is not necessary. Sometimes a well-targeted marketing message is enough.

Targeted marketing is the first step that will help auto services maintain as much of last year’s revenue as possible in 2021. Many practical insights into improving marketing and business practices can be gathered from receiving service technicians. Utilizing their input is a relatively cost-free way of improving the quality of your targeted marketing campaign.

Engage social networks

Social networks can also be a valuable source of completely new income. Today you will find there all customers of your competitors, whether branded or non-branded. You should not forget about the fan sites either. Today, fans of almost every carmaker have their own group on Facebook or on a discussion forum. There you will find a lot of owners of older vehicles who also want to keep their car in the best condition possible even if they no longer visit branded service centers. All that matters is just data analysis and the desire to experiment.

How to ensure sales for the service center? Join data with your dealership

You may have a rather relevant question about how to manage all this or set it up in your service center where practically neither sales nor marketing were done before. It’s simple, you’ll just need the appropriate specialized IT tools. An example of such a specialized solution is Automotive CRM from Konica Minolta. It can connect data from the service, social networks, and even your dealership (including all its branches, or other brands), giving you a 360° vide of each customer. And for any type of targeted sales or marketing activity, this is the most important thing to have. It can be implemented for the entire dealership and service center in just 30 days.

Sometimes in CZ, there is the management of the implementation. I dont think the separation is necessary and could just be implementation.

The end of internal combustion engines will change the rules of the game

Internal combustion engines are nearing the end of their lives. In Europe, a deadline of 2035 has been set and, in the US, they have begun talking about a similar date to come into effect, which is already valid in California for example. But the end of internal combustion engines will change the car market in one fundamental way – it will remove the main barrier to entry for Chinese carmakers, and they cannot wait for this to happen.

Inconspicuous China is dominating the EV market

Anyone that knows at least a little about the Chinese car market knows that there are dozens of domestic carmakers that are literally fighting for a piece of the local market. And it’s not a small market. In 2010 it reached a million cars sold per month and just before the onset of the pandemic it was more than three million. The pandemic and ensuing global chip shortage pushed June sales to just over two million, a 28% drop from December 2020, but brought record sales of electric vehicles. They already account for 15% of all vehicles sold and their share is constantly growing (by 160% year-on-year). And Chinese carmakers are continuously pushing out new models. Even compared to the locally very well-established Tesla, the pace of production is breathtaking. At the same time the Chinese market represents 50% of the global EV market and McKinsey expects that by the year 2030, 9 million EVs will be sold in China yearly.

In the first half of the year, 1.1 million EVs were sold in China, while in other than the Tesla Model 3 and Model Y, the ranking of the top 10 best-selling brands was occupied exclusively by Chinese manufacturers. The Wuling Hong Guang MINI EV minivan is enjoying massive success, with an

incredible 181,810 units sold. The monthly sales of this mini-truck in China reach similar numbers as the European sales of the Volkswagen Golf. The top 10 is completed by BYD, Great Wall, GAC (GAIC), Li Xiang, Chang’an and Chery. BYD has been aggressively targeting Tesla, especially in recent months. However, Chinese carmakers are now chomping at the bit in other markets as well.

Why China is beating the US in electric vehicles

Inconspicuous expansion

The fact that the Chinese can gain significant traction is best shown on the Russian market. Russia does not have as strict emission limits as Europe or the US, so the Chinese can even compete with internal combustion engines. The Geely Group, the Chinese owner of Volvo and the 9.7% shareholder of the German Daimler, which last year founded a new EV brand called Zeekr to be launched this autumn, best shows how quickly the Chinese carmaker can succeed here. Geely only entered Russia last year, as part of its expansion out of China to markets in the Philippines, Kuwait, Saudia Arabia, and Myanmar. In Russia it offers the SUVs Atlas, Coolray, Tugella, and Atlas Pro. The latter, built on Volvo technology, climbed up to the ranks of the top 25 best-selling cars in Russia in June 2021, with sales increasing 300%. Coolray can be compared to the Škoda Karoq in terms of size, technology, and performance. In a price comparison, the Karoq starts at 14% more expensive for the base model, but is almost twice as expensive as a Geely when fully equipped. The Geely also comes with a 5-year warranty. Geely’s approach to the Russian market gives an idea of what such an expansion in the EV area might look like. The above mentioned Wuling Hong Guang MINI EV will cost only 4500 USD, a third less than the comparable Citroen Ami.

Western joint ventures in China will help the Chinese in the West

In fact, the expansion of the Chinese to the West may happen much faster than expected. The Chinese can benefit from their current joint ventures (e.g., SAIC Volkswagen, SAIC Volkswagen, SAIC GM, BAIC Hyundai, DPCA (Dongfeng and PSA), GAIC Toyota, GAIC Tesla, and many others), which Western carmakers had to establish as a condition of entry into the Chinese market. Additionally, the Chinese carmakers can benefit from their holdings in Western carmakers such as in the case of Geely or SAIC (GM, Roewe).

China took Norway by storm

The Chinese expansion into lucrative Western markets has already begun. The most lucrative market, Norway, where B/PHEV has reached an incredible 84.9% of total sales in July 2021 with 17,323 cars sold, has seen the entrance of the Chinese BYD with its family SUV Tang. BYD wants to sell 1500 of those vehicles this year and is already operating on Scandinavian markets with its electric buses. On one hand, entry to Norway is much easier than to other European markets, but on the other hand, it is the most competitive electric vehicle market in the world.

At the same time, BYD, as in China, will meet its match mainly with Tesla, who has nearly doubled the sales of the 2nd most popular electric car, the Ford Mustang Mach-E, with sales of the Model 3 in Norway. The target of 1500 cars sold in the first half of the year in Norway could be enough to place BYD in 10h place, which was occupied by the “British” MG ZS EV with 1579 cars sold. But it may be worth remembering that MG Motor was bought in 2005 by the Chinese Nanjing Automobile Group, a member of none other than SAIC, which is actually has a joint venture between VW and GM in China. In addition, the 9th place position with 2349 cars sold in Norway belongs to the Polestar 2 model, part of the Chinese Geely. So, in fact, Chinese electric cars have been quietly building a presence in the West for quite some time.

How to prepare for the Chinese? They are not afraid of new business models

Chinese carmakers have long understood that classic sales models are dead, or that they do not work so well with EVs. In addition to the classic model of owning a car or leasing, you will often come across a model for battery leasing in China. You can buy a car from the carmaker, but you will get its battery in the form of a service. Therefore, you don’t have to worry about its capacity decreasing, subsequent exchange, or disposal. The Chinese thus eliminate the biggest barrier to purchase, especially for cars with low battery capacity, which are logically cheaper.

In addition, some dealers have started offering another model – you own a vehicle without a batter, you are leasing a battery, but not a specific one. So, when you need to hit the road quickly, you just have the battery replace by a freshly recharged one and you’re driving. Naturally, such cars are built for this service so that the replacement only takes a few minutes. Carsharing is also very popular, which allows you to rent an EV for a specific number of minutes.

So how can you prepare for the expansion of the Chinese? It is important to know your customers and what they expect from their car. But you must also be prepared for the rapid introduction of new business models, which are so far unusual for Western carmakers. A specialized flexible cloud-based Automotive CRM for car dealers can help you with this, which will not only easily help you add new brands and models to your portfolio, but also introduce new sales and service models using all the existing information you have about your customers.

Sources

https://www.reuters.com/article/us-autos-emissions-california-exclusive-idUSKBN2BE111

https://tradingeconomics.com/china/total-vehicle-sales

https://insideevs.com/news/522274/china-plugin-car-sales-june2021/

http://global.geely.com/media-center/news/geely-auto-2020-sales-reach-1-32-million-units/

https://insideevs.com/news/517969/norway-plugin-car-sales-june2021/

Connected Cars

Connectivity in modern cars opens up a wide range of new possibilities. At the same time dealers can take advantage of these opportunities and create their own services. Where did connectivity in cars come from, what direction is it going, and how can money be made off of it?

From OnStar and eCall to OTA updates and beyond

Car connectivity dates back to 1996, when a subsidiary of General Motors, OnStar, began equipping selected group cars with a paid (subscription-based) system for emergency calls, and later for navigation and remote diagnostics. Three years later with the launch of the European satellite navigation project Galileo, an eCall system was proposed to automatically contact emergency services in the event of an accident (including the geographical location and condition of vehicle systems). The eCall system was to be implemented in all cars sold in the EU, however this did not happen until 2018. In the meantime, not only did systems for location tracking and remote diagnostics get into cars, but thanks to Tesla also remote updates for various functions, including the possibility of unlocking speed boosts (Ludicrous mode) or increasing battery capacity (in the Model S for example where the lower-end model has the same battery as the high-end car). Today, connectivity in cars, usually provided over a mobile 4G network, can provide support in emergencies, fleet management, and diagnostics. However, it also allows carmakers and dealers to sell new functions and benefit from marketing collaboration, for example when recommending new applications or points of interest on a journey.

Connectivity brings new applications

However, connectivity in cars will soon go much further. Soon we will see the remote prediction of a failure, which is commonly seen today for example in elevators or on production lines, which will help identify potential problems in the car over time. There are also new applications for leasing companies, company fleets, and dealerships that can work with existing telemetry data. Monitoring a car’s daily mileage limit, or even the departure from the rental region is child’s play, even today.

The future lies in infrastructure, security and autonomous management

The key is however, future connectivity, which is moving in a completely different direction. For example, pilot projects are funning to connect cars to parking lots so that drivers will know which lots have a free parking space. Since the time of RDS-TMC, traffic intelligence and route rescheduling through navigation have become a standard practice. In the near future however, it will all be controlled by artificial intelligence, which will aim to proactively optimize road traffic permeability to prevent traffic jams.

The breakthrough will occur after the introduction of inter-vehicle communication. Thanks to data from cameras and other sensors, cars will be able to automatically inform each other about obstacles or animals on the road, ice, weather conditions, or even pedestrians. And the driver, but later even the vehicle itself, will be able to react in real-time, which will help prevent accidents.

What will connectivity bring to dealers?

The main question for car dealers is different – how to make money on it all? And the possibilities are perhaps unexpectedly wide. The first, most logical, possibility is to reduce fleet management costs. Today it is no longer a problem to remotely monitor all replacement and test vehicles, both in terms of their location and use, but also for example to check tire pressure, batter condition (including the EV powertrain), fuel levels in the gas tank (which is especially useful for diesels), error codes, or whether the car has been parked somewhere for a long-time while unlocked. This, of course, will help prevent a number of problems.

But there is another option – if you have cars in the fleet, from which you can read even the driving style and the way the car is used, it can dramatically help you with sales, including upsell accessories. Do you have a customer who plays loud music in a loaner car? How about offering him/her better-quality speakers in his vehicle? Do you have a customer who has rented a more powerful car than he/she current drives and enjoys fast acceleration and higher speeds? How about offering an inventory car with higher performance? Do you have a customer that travels mainly short routes around the city? How about offering him/her an EV? There are many possibilities, you just need to have in addition to car connectivity, a 360° customer view – to know what kind of car/s they have, what is important to them, what cars they bought in the past, what they complained about, etc. Konica Minolta’s specialized Automotive CRM will help you with exactly that.

But that’s still not all. Do you already have someone who checks the status of your dealer fleet by measuring data remotely? What about offering your customers a paid remote care service for their car? Covering the same things you do in your fleet – tire pressure, oil level, battery status, error codes (including e.g., a broken bulb), unlocking/locking the car. It is then super easy to pick up the phone and call a customer about a problem with their car when it is automatically detected. Just don’t do it for free.

In the future, connected cars will bring even more business

But that’s still not all, because there will be other business opportunities in the future. A number of carmakers, including Mercedes, are preparing their dealers to sell features online. It is about far more than just navigation, which has long been the primary sold feature by dealers. Dealers will now be able to sell a range of new features, and if they know their customers and their needs well, they will be much more successful than carmakers in selling these features. In addition, as the complexity of new features increases, so will the need to train customers in their use. And this is another opportunity that many dealers are already taking advantage of. In the future, it will no longer be about defensive driving schools, but also about teaching how to use driving assistants or built-in infotainment. Dealers who have a 360° customer view will significantly expand their chances of earning money from these opportunities.

Sources:

https://open.spotify.com/episode/4UmbmclpLnDcbb766aGNKY?si=NRa7eK3lTUGEN-1hPVrOmQ&dl_branch=1

https://en.wikipedia.org/wiki/OnStar

https://en.wikipedia.org/wiki/ECall

End of combustion engines in the EU by 2035?

In mid-July, the European Commission decided that it wanted to the end the sale of motor vehicles with internal combustion engines by 2035 to be replaced by electric vehicles. This step comes at a time when a significant number of car manufacturers have announced the end of internal combustion engines in horizon of the next 15 years. What does this mean for dealers?

The EU intends to increase emission standards

The European Union is failing to meet its original targets for reducing CO2 emissions not only from car transport. With weather fluctuations in July causing large-scale floods in Belgium, Germany, and the Netherlands, a tornado in the Czech Republic, or an unexpected heat wave in Spain, the climate change debate is intensifying. According to commissioner Adina Valean, transport is responsible for 29% of all EU greenhouse gas emissions (cars are responsible for 12%). By 2050, the commission wants to reduce these emissions by 90%. Banning internal combustion engines in cars and vans could be a way to reach that goal.

Some manufacturers are in turmoil

At present, it is still only a proposal that is opposed not only by some representatives of the car industry, but also by politicians. For example, the German MEP Peter Liese said that the end of internal combustion engines by 2035 could be a major problem for manufacturers of components of these engines. At the same time, he is not the only one in the European Parliament who has reservations about the current proposal. So, what will happen next?

Every two years, a report on the direction of the market is drawn up, and a complete revision of the regulation is due in 2028. At present, cars in the EU can produce 95 g of CO2/km, while in 2030 it should be 55% of that figure and from 2035 net zero. For delivery vans, it is now 147 g of CO2/km, which will fall to half by 2030 and by 2035 should also be zero. Until 2030, only small manufacturers with an annual production of 1000 – 10,000 cars or 22,000 vans can apply for an exemption. The European Commission has already announced that it will prepare proposals for the sale of electric cars, which will come into effect by 2030 latest. Similar programs already exist in key markets such as France or Germany, contributing to a massive increase in electric car sales.

Electric cars lack infrastructure

The key problem, which has been highlighted by manufacturers, is the lack of charging infrastructure. Some car manufacturers have strongly criticized the European Commission for this, suggesting that if the EU does not invest in charging infrastructure, it is unrealistic to achieve the newly set goal. The European Commision responded by proposing mandatory construction of public charging stations (paid for with public money) on all major roads with a maximum distance of 60 km between them by 2025. By 2030, there will be total of 3.5 million public charging stations in the EU, and 16.3 million by 2050. However, the charging stations are being built in parallel by the manufacturers themselves, whether it is Tesla or the Ionity consortium backed by BMW, Ford, Hyundai, Mercedes-Benz, Volkswagen, Audi, and Porsche.

Dealers and service stations are not ready for electric cars

The electric vehicle problem will soon affect dealers as well. Although they are ready to sell electric cars, their infrastructure is absolutely not adapted for them. In short, dealerships are not ready to recharge 15 demonstration vehicles at the same time with fast charging, not to mention recharging vehicles in service. Building a charging infrastructure consumes money and time. In addition, many dealers will struggle with the insufficient capacity of the electrical transmission grid, as even 10 fast charging stations with an output of 150 kW will require an electrical connection of a respectable 1.8 MW, which is equivalent to the electrical consumption of a medium-sized factory. The European Union will fact the same problem. To be able to transition to electric cars, it will be necessary to significantly strengthen the transmission grid and electricity generation capacity.

Another problem will be with service. New tools will be needed for the repair and maintenance of electric cars as well as different facilities. This will apply in particular to the handling of batteries that are highly flammable, explosive, susceptible to physical damage, and most importantly, high weight. While portable systems for removing an internal combustion engine have been part of the standard equipment of a car service for decades, most services do not have the equipment or the necessary space for handling batteries.

Prepare for the revolution in time

The necessary preparations for dealerships and service centers could thus be divided into three categories. The first is the charging infrastructure, not to mention that some discounted charging point for customers could be an interesting marketing tool. The second category is service and facilities. Both will require massive investments and major renovations with long-term returns. The third category is sales. This will change significantly, because customers will suddenly become interested in a completely different range of parameters than before – range, charging speed, availability of charging stations in their place of residence, speed of single-phase charging (from 230V home chargers), etc. A tool that can deal with these changes is the specialized Automotive CRM from Konica Minolta, for example. It enables a comprehensive 360 ° customer view, from their interactions with car dealers and service centers, thanks to which you will more easily identify a suitable electric car for them. Furthermore, you can combine your offer with targeted subsidy incentives that the EU is now preparing with member states. As always, the player that wins is the one that is able to adapt the fastest to market changes.

Sources

https://fortune.com/2021/07/14/automakers-europe-ban-of-new-combustion-engine-cars-by-2035/

How carsharing affects your business

Carsharing is an emerging trend, heading to all major cities across developed countries. What does carsharing look like, what can we expect from it, and how will it change the car business?

What is carsharing?

Carsharing is a relatively new approach to car use based on the idea of sharing one car with multiple people. Standing behind the idea is the rather logical reasoning that suggests that for most of the time we own a car, it sits in the garage. Therefore, car ownership is relatively inefficient with high fixed costs – acquisition costs, road and environmental taxes, leading to a high cost per km driven. The idea of carsharing at the turn of the century aimed to reduce these costs.

However, other, newer factors are increasingly supporting the idea of carsharing. Firstly, cities are becoming more and more crowded and finding a parking place is becoming more difficult. Carsharing solves this problem because it reduces the number of cars per capita. Secondly, too many cars is unecological as each car produces a significant carbon footprint during production, transport, and disposal. The is doubly true for electric cars because the lithium ion batteries often need to be mined and manufactured in areas far away from vehicle production. Additionally, these batteries are difficult to dispose of in an environmentally friendly manner. It therefore makes sense to reduce the volume of cars produced. It therefore makes sense for governments to support carsharing among cars with minimal (e.g., CNG) or zero emissions. The bottom line is thanks to all these factors, carsharing is riding on a wave of popularity.

Carsharing is always different

There are several types of carsharing. They all build on the one main idea that you do not actually use or need a car most of the time. Depending on the type of carsharing, various other factors come into play. In particular, the following three carsharing models are most popular worldwide:

- Co-ownership – literally the joint purchase of a car by several households or a community, but with not for professional use.

- Professional carsharing (free-floating) – built on vehicles purchased by a carsharing operator (often associated with a car manufacturer, importer, or dealer). The goal is to profit from very short-term (often hours or even minutes) rentals inside large cities. Government support often plays a role in the form of free entry to the city center, free parking, or relief from road taxes and tolls. This usually comes with a requirement for low-emission and zero-emission cars.

- Carsharing built on a shared economy (peer-to-peer) – essentially an AirBnB for cars, where people or even companies share their privately owned cars with others. The carsharing provider merely provides a platform for carsharing.

In the last two types of carsharing usually work where those interested in taking part register on a carsharing platform, provide necessary documents, enter their payment card details, and if necessary, make a deposit or pay a recurring monthly fee for using the platform. They then access a mobile application that shows them available cars in their vicinity. Payment is made for the duration of the loan (usually in minutes), for kilometers travelled, or a combination of both. Many carsharing plaforms offer discount packages for a fixed amount of time – certain hours, days, weekends, weeks, etc.

Professional carsharing services offer the possibility of using a chip card or mobile phone instead of a key in modern cars. Carsharing users only need to walk up to the parked car on the street, activate the car via the mobile application, and then they can immediately unlock it and drive away. This solves the problem of securing and sharing car keys. Refueling is usually solved through refueling cards or access to charging points. The carsharing operator then continually maintains the entire fleet including service intervals, changing tires, and, if necessary, settling insurance claims or redistributing cars to different locations.

Autonomous cars will change the rules of the game

Another form of carsharing will appear very soon. General Motor’s subsidiary, Cruise, has been working on something new for several years in cooperation with Microsoft. Cruise is taking advantage of fully autonomous electric Chevrolet Bolt EV vehicles. The first active test took place in October 2020 in San Francisco. In reality, it was the result of five years of research and development, where electric Bolts had traveled autonomously for more than 2 million miles.

GM’s Cruise is more of competition to Uber, however. From the user’s point of view, it works identically. The user opens the Cruise application on their mobile phone, orders an autonomous Bolt EV to their address, enters the destination address, and that’s all there is to it. The Bolt EV, which can be followed in real time in the application, will come for the client, take them to a destination, and then automatically go pickup another client. The user is then charged for the driving duration, similar to many carsharing programs, and the same as with Uber. It is important to note that perhaps it is not an accident that the public test of Cruise took place during the coronavirus pandemic. COVID has significantly changed views about the possibility of driverless passenger car transport, and mass public transport has suddenly become dangerous.

What carsharing means for auto dealers

At first glance, it might seem like carsharing is something that is anti-sales. The goal is for one car to be shared among many people. But in the days of coronavirus, carsharing can be a way to attract more people to personal cars. Even a person without their own car can get to work for a few dollars or Euros, safely, and without being in contact with other people.

Apparently, car manufacturers also see an opportunity for growth in carsharing. And we don’t just mean GM and their future attempt at creating competition for Uber. Some car companies are working on their own carsharing programs. It is worth mentioning that Škoda Auto, part of the Volkswagen Group, has built its own carsharing program, HoppyGo, in several countries based on an open economy. It is used to share cars from any brand.

Professional carsharing services are actually a classic fleet customer, which, unlike large companies, has the potential to sell, for example, a pickup service, car cleaning, sales or rental of accessories, etc. Everything is about how dealers integrate carsharing, because stopping it is not an option.

Sources

https://en.wikipedia.org/wiki/Carsharing

A car subscription added to operational leasing

A new car every month. A car subscription is exactly what some car manufacturers and leasing companies are offering in selected countries. This relatively new service is intended to complement increasingly popular operational leasing and could quite possibly shake up the car market. What will be the impact?

What is a car subscription?

A car subscription is a kind of intermediate stage between a rental company and a traditional operational lease. As with a car rental company, the customer does not need to worry about anything – service intervals, tire changes, insurance, road and environmental taxes, and in the case of electric or hydrogen cars, sometimes even charging is included in the service. The user only has to take care of refueling, windscreen washer fluid, tolls, and parking fees, nothing more – in short, a car as a service. Many subscription services even include delivery of the car to an agreed address.

The key here is the duration of the subscription – it ranges from a single month to a quarter, half year, nine months, or a year. Sometimes, for example with Porsche USA, it is possible to rent a car for a single day. Car subscriptions are offered in various markets either directly through car manufacturers, leasing companies, or rental car companies. It is a special market where all these players compete at the same level. After the end of the several-month contract, it is possible to continue with a new car or terminate the contract.

Subscription vs. leasing

At first glance, the differences between a subscription and leasing may not be obvious. The main difference is the duration of the contract. The second difference is that opposed to a regular lease, it is not possible to buy the car at the end of the contract, like a car rental service. A key difference compared to operational leasing is that car does not have to be new and that it is not possible to choose its configuration. Most offers include cars that are up to two years old and a pre-selection of models, engines, and equipment.

The truth is that current operational lease offers are sometimes very similar to subscriptions. There are leasing providers that offer only annual or even six-month contracts, and in addition to insurance and taxes (road and environmental), they include tire rotations and service in the lease. These offers are not available in all markets, and they are also not always welcomed with open arms. Car subscriptions can also be attractive from a marketing point of view. In the days of Spotify, Netflix, Adobe Creative Cloud, and Microsoft Office 365, more and more companies and consumers are getting used to everything in subscription form. In many markets there are even mobile phone or laptop subscriptions. So why not “sell” and especially promote cars in the same way?

Who will benefit from a subscription?

A subscription would be ideal for new drivers. Of course, most providers know this, and that’s what they’re trying to prevent. Many services require a minimum age of 25 and several years of driving experience. So, for new drivers, the service is, so far mostly unavailable.

However, there are other usage scenarios for the retail segment. A family car for a few months is suitable for employees who have been recently fired and need to return their company car, or for those who take a so-called sabbatical for exactly six months or a year. In some countries, the possibility to cover the absence of a company car applies to a large group of customers who would welcome such an offer with open arms.

Car enthusiasts might enjoy another option with brands such as Porsche. Having a new, and especially different Porsche every month is a childhood dream of many boys. But few can afford it. At $3100 a month plus tax, which is the price of Porsche Drive in several major cities on the West Coast of the United States, such a dream becomes a reality, if only for a few months.

The ideal target group is also companies, especially those running a seasonal business. With limited contracts, they can rent company cars only for a few months, for example during a given season. However, it could also be advantageous for companies employing interns or employees from other branches. Another interesting target group could be contractors who are in a location for only a few months before they finish their contract.

And then we have an electric car subscription. For many companies they serve as a demonstration of the company’s commitment to the environment. And being able to show purely electric cars at summer company events for example, is something that many companies would be interested in. After all, Citroën chose to cooperate with selected companies to offer its utility vehicle, Ami, as a subscription. And other manufacturers such as Mercedes-Benz or Ford have also begun to offer a subscription service for their commercial vehicles.

Car subscriptions are gaining traction

But do car subscriptions have a chance to gain traction in the market? Definitely yes. It just may not be a widely available service. They can be expected to address only specific segments and parts of the market. However, as you will not find them everywhere in the US, the same is true for Europe. But how will car subscriptions change the market?

Some automakers want to go the way of direct sales or sales through their own financial institutions. Of course, this will not please dealers much, especially if the pricing policy will be more favorable then buying your own car. But carmakers will not be able to service the cars themselves. Dealers will be needed for this. For dealers, it pays to cooperate with car manufacturers. Those who are more proactive will have an advantage. This will especially apply to larger dealerships with multiple locations.

Those who have solid CRM data and know their clients will have a better bargaining position for car subscriptions, not only in cooperation with manufacturers. Dealers using advanced specialized CRM systems such as Automotive CRM, which offers a 360° customer view including social network interactions, will be able to generate quality leads for subscription services.

In addition, dealerships will be paid a handsome fee for providing quality leads, just as they do today with leases and loans. At the same time, winning a customer if only through a commission on the car subscription and service can be a source of new income. After all, it can be expected that car subscriptions will be purchased by different customers than those who typically come to buy a new car. And how are you prepared to take advantage of the opportunity that car subscriptions bring?

Sources

https://www.forbes.com/wheels/advice/car-subscription-services/

https://www.thebalance.com/best-car-subscription-services-5095656